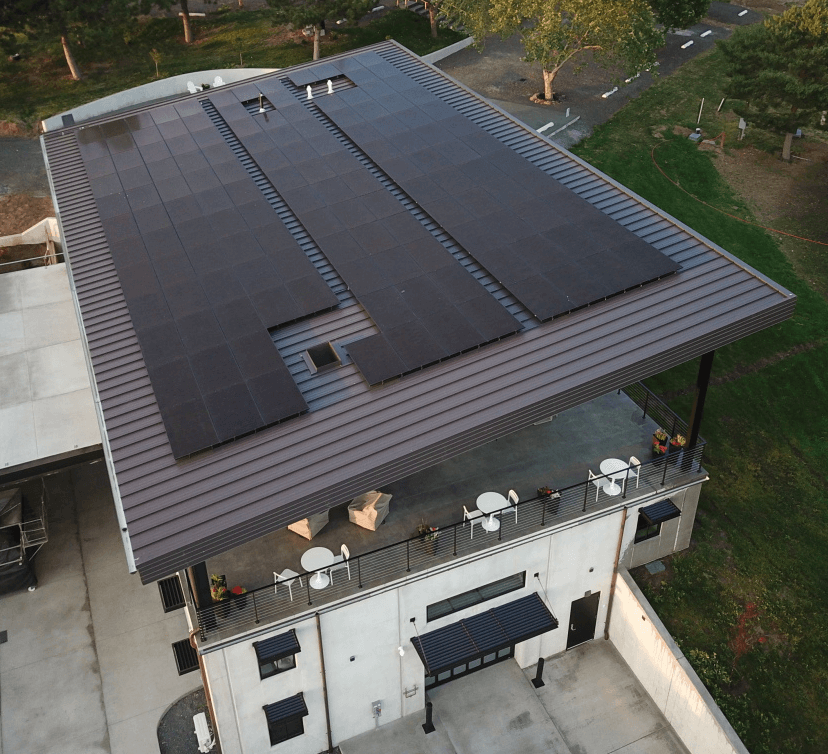

Washington solar incentives are some of the best in the country—but they won’t last forever. If you’ve been thinking about solar for your home, now is the time to act.

Rising electricity costs, changing net metering policies, and potential shifts in solar incentives mean homeowners who wait could miss out on thousands in savings.

Washington Solar Incentives

Reducing The Upfront Cost of Installing Solar for Your Home

Seattle Solar Incentives

Low-Cost Solar Financing

We partner with trusted local lenders to offer zero-down, low-interest solar loans with no balloon payments. For a limited time, homeowners may qualify for 0% interest and no payments for 90 days through PSCCU.

Clean Energy Credit Union offers low-cost, zero dealer fee loans for solar and storage, with interest-only payments for the first 15 months and flexible options like reamortization and refinancing. They also provide a 0.5% interest rate reduction for Low-to-Moderate Income (LMI) and BIPOC households to support energy equity.