You Could Be Paying More With Dealer Fees

Solar installations have become increasingly popular in Washington and Oregon.

So have the options to finance those solar installations. However, some come with hidden costs like solar dealer fees, making solar financing a bit more complicated—and often more expensive.

Considering solar financing? Here’s what you need to know.

TLDR

![]() Solar financing options from national solar installers often have a hidden dealer fee, increasing the cost of installing solar on your home.

Solar financing options from national solar installers often have a hidden dealer fee, increasing the cost of installing solar on your home.

️️️![]() These dealer fees decrease monthly payments but increase the amount you pay for a solar loan.

These dealer fees decrease monthly payments but increase the amount you pay for a solar loan.

![]() Advocating for fair and transparent solar policies that benefit homeowners and local communities.

Advocating for fair and transparent solar policies that benefit homeowners and local communities.

![]() Some loans also use balloon payments, requiring a large, one-time payment (often covered by your tax credit) to keep monthly payments low. (i.e. your tax dollars go to a large financial institution, and not your wallet

Some loans also use balloon payments, requiring a large, one-time payment (often covered by your tax credit) to keep monthly payments low. (i.e. your tax dollars go to a large financial institution, and not your wallet

![]() Ask for clear breakdowns of all fees, and consider alternatives like working with local credit unions, which usually offer transparent loans without extra dealer fees.

Ask for clear breakdowns of all fees, and consider alternatives like working with local credit unions, which usually offer transparent loans without extra dealer fees.

What Are Solar Dealer Fees

Solar dealer fees (sometimes called a finance fee) are extra charges added to your solar loan.

They’re common for solar loans provided by national, third-party lenders who partner with solar companies.

These financing fees help lower monthly payments by reducing the interest rate, making the loan look more affordable.

But here’s the catch: dealer fees increase the total cost of the solar loan (sometimes greatly), so in the long run, you end up paying more.

How Does a Solar Loan Work

A solar loan lets homeowners spread out the cost of their solar installation over time instead of paying everything upfront.

Many solar loans have fixed interest rates and terms ranging from five to twenty-five years.

Homeowners use the savings they would otherwise pay on utility energy to repay the loan.

Easy enough–yes, but…

The dealer fee can make these loans more expensive over time, even if they lower the monthly payments.

What’s more, they make it unclear what you’re actually paying for because they’ve baked the dealer fee into the total cost of your solar installation.

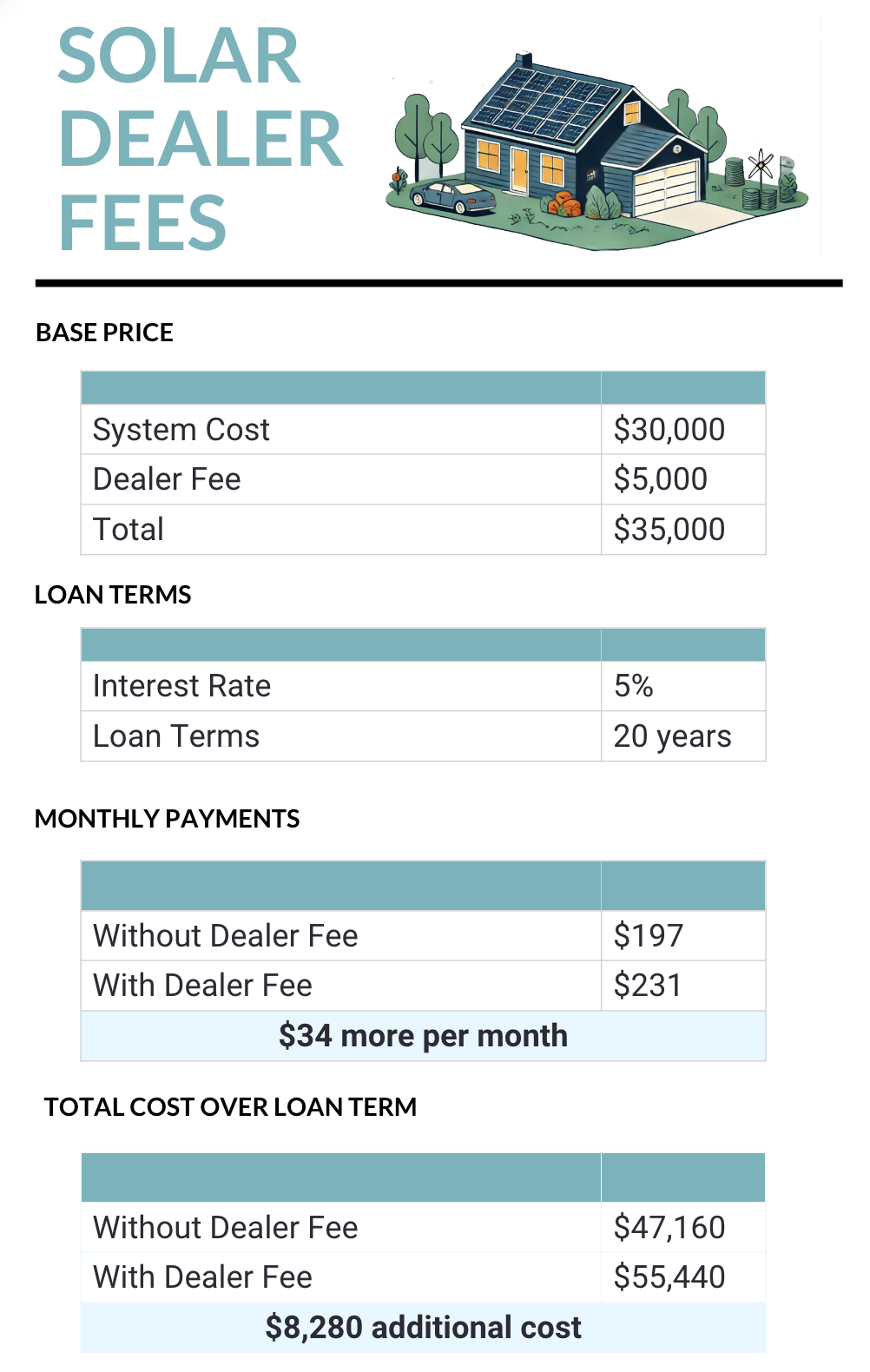

Solar Financing Example

Let’s say a homeowner decides to install a solar system that will cost an estimated $30,000, including panels, inverters, and installation.

Base Cost:

System cost: $30,000

Dealer fee: $5,000 (this can range from 15% to even 50% of the total cost of the system. This scenario assumes a dealer fee of around 15%)

Total Loan Amount:

Total amount financed = $30,000 (base cost) + $5,000 (dealer fee) = $35,000

Loan Terms:

Interest rate: 5%

Loan term: 20 years

Monthly Payments Calculation:

Monthly payment on $30,000 at 5% over 20 years: approximately $197

Monthly payment on $35,000 at 5% over 20 years: approximately $231

This results in an additional $34 per month due to the dealer fee.

Total Cost Over Loan Term:

Total payment for $30,000 loan over 20 years: $197 x 240 months = $47,160

Total payment for $35,000 loan over 20 years: $231 x 240 months = $55,440

![]() With the dealer fee added, your total loan amount becomes $35,000.

With the dealer fee added, your total loan amount becomes $35,000.

️️️![]() At a 5% interest rate over a 20-year term, your monthly payment would go up from about $197 (for a $30,000 loan) to about $231 (for a $35,000 loan).

At a 5% interest rate over a 20-year term, your monthly payment would go up from about $197 (for a $30,000 loan) to about $231 (for a $35,000 loan).

![]() This small monthly increase adds up to $34 a month, leading to an additional $8,280 over the loan term.

This small monthly increase adds up to $34 a month, leading to an additional $8,280 over the loan term.

How Solar Dealer Fees Affect Your Loan Interest Rate

Dealer fees decrease your loan’s interest rate by increasing the total cost of a solar energy system.

On paper, this makes monthly payments seem easier to manage. However, it means you’ll be paying more interest over the long haul.

According to the Consumer Financial Protection Bureau (CFPB), solar dealer fees can be hard to spot, making it tricky to understand your total solar panel installation cost.

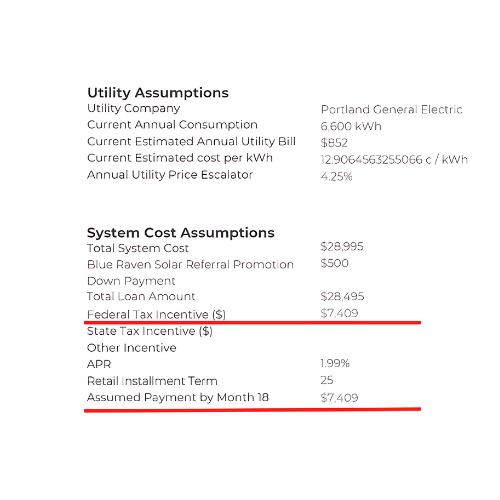

Solar Loan Balloon Payments

In some cases, lenders offer solar loans with a balloon payment—a large, one-time payment that homeowners make at a specific date. This will keep their monthly payments low, usually for the first 12 to 18 months.

The idea here is that homeowners use their federal tax credit (often received a year after their solar installation) to make this balloon payment; in effect, paying down their interest rate after 12 to 18 months.

But there’s a catch. If you don’t qualify for the tax credit or can’t make this big payment, your monthly payments will increase quite a bit.

This is why it’s essential to check if you’re eligible for the tax credit and to have a backup plan if the balloon payment is too much to handle.

Why Dealer Fees Can Be A Problem

Dealer fees mean you’re borrowing a bigger amount, which leads to higher interest payments over time. Here’s a quick look at what this means for your bottom line:

- Reduced Savings: Higher financing costs mean it takes longer to recoup your investment, reducing the return on your solar investment.

- ️️️Loan Approval Challenges: A dealer fee often increases how much you pay a solar company, making it harder to qualify for a solar loan or fit it comfortably into your budget.

The Pros And Cons Of Dealer Fees In Solar Financing

Pros:

- Greater Access to Loans: Dealer fees help lenders offer financing to a broader range of homeowners, which can make solar more accessible.

- ️️️Lower Monthly Payments: The dealer fee can make monthly payments lower, making your solar loan more affordable every month.

Cons:

- Increased Total Cost: The total amount you repay is higher, which can eat into your solar savings

- ️️️Confusing Loan Terms: Hidden dealer fees can make it hard to understand the true cost of solar for your home, which may prevent homeowners from making fully informed decisions.

- ️️️Trade-Off with Other Financing Options: Loans with dealer fees may seem more affordable upfront, but could cost more than other options without added dealer fees.

- ️️️Federal Tax Credit Compliance: Some states (see Washington Solar Consumer Protection Act) require lenders to disclose solar dealer fees. Financing fees are not eligible for the federal tax credit. Many lenders will not disclose their financing fees, and if they do, it complicates how much the federal tax credit is applicable to a solar or battery system.

Tips For Homeowners Considering Solar Financing

When it comes to solar financing, transparency around solar dealer fees is essential. While some consider these fees a standard cost, others view them as unnecessary additions. Here’s how you can make informed choices:

- Shop Around: Compare different loan offers, and make sure you’re looking beyond the APR to get a full picture of the costs.

- Ask For A Breakdown: If a dealer fee is included, ask how it affects your monthly payment and the total loan cost.

- Look into Alternative Solar Financing Options: Sometimes, home equity loans or even cash payments can save you more in the long run, without the hassle of dealer fees.

- Calculate the Long-Term Costs: Your solar savings should ideally outweigh the total financing costs, so make sure you know what you’re signing up for.

Final Thoughts

Solar dealer fees are a common part of solar financing. However, they often make the loans more costly. While these fees may open up more solar financing options, they also add to the total amount you pay, which can reduce the financial benefits of going solar.

When it comes to solar financing, partnering with a solar company that works with a local community credit union can be a smart choice. Unlike many national lenders, community credit unions often offer solar loans without the added dealer fees.

Local credit unions also tend to be more transparent with their lending practices. They focus on building long-term relationships within the community, which means they’re more likely to provide clear, straightforward loan terms.

These options are likely to be more secure, fair, and affordable—without hidden fees or confusing terms. This approach ultimately maximizes the financial benefits of going solar while contributing to your community.

The Solar Scam Series

This is just one of the many solar scams homeowners need to watch out for. Keep reading our Solar Scams Series to stay informed and protect yourself from other common tricks used by shady solar salespeople.

Learn how shady companies hide fees and overpromise savings

These ‘cheap’ loans may cost thousands more than you think

This business-only tax perk is being misused in sales pitches

Salespeople love saying it is—here’s why they’re wrong

Promises of total energy savings often don’t add up

What happens when your roof needs work and your installer ghosts you

Some companies falsely claim their from your utility to earn your trust