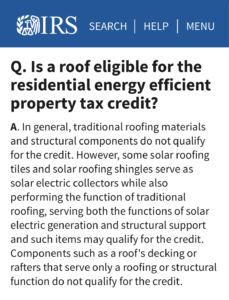

No. While we are not tax experts, we can assure you that adding the cost of replacing your roof into the federal income tax credit equation is a bad, bad idea. Don’t listen to any contractor who tells you otherwise. You don’t want to give the IRS any additional reason to audit you, and you especially don’t want to have to repay the ineligible tax credit, plus interest, when you least expect it.

Battery storage systems like Tesla Powerwall can be included in the ITC if they are charged primarily with solar power.

Battery storage systems like Tesla Powerwall can be included in the ITC if they are charged primarily with solar power.

Don’t believe us? Ask your tax accountant or consult the IRS fact sheet on energy-efficient home improvements and residential clean energy property credits.

Things You Should Know Before You Go Solar

We’ve compiled some of the questions we have received over the years. We think people should ask a solar contractor some tough questions when they are considering installing solar. We want you to have the information you need so that you can make the decision that is best for you. Customers who are educated about solar make our industry stronger.

Help us create smart, educated solar customers and a strong, local solar industry! Share this post!