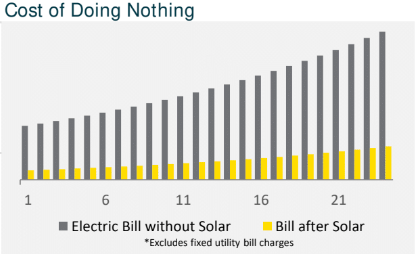

If you’re like most Americans considering solar panel financing, then you might be waiting for more favorable interest rates. However, there’s a cost to waiting.

Oregonians are now paying around 18% more for electricity in 2024, while just a year before, 2023 marked the fastest rise in Seattle-area power bills in the last decade.

On the other hand, installing solar can save you money, even in today’s high-interest rate environment. That’s because unlike other purchases requiring financing, a solar energy system isn’t a sunk cost. A solar installation serves as a long-term investment that hedges against rising utility rates, while also increasing the value of your most important asset: your home.

What’s more, you’re guaranteed a return on your investment, as there’s a direct relationship between increased utility rates and the monthly savings provided by solar. That’s to say, the more utility rates increase, so does the rate of return on your solar investment.

On top of that, solar incentives at the federal, state, and local level are all subject to change, as are utility bills. The notable difference is that while solar incentives can decrease given budget constraints, as they often do, utility bills continue to rise.

Consider the current solar landscape and the importance of securing these solar incentives before changes go into effect.

Federal Tax Incentive: Reducing the cost of installing solar by 30% of system cost.

Net metering: Securing this utility incentive now significantly increases your return on investment. However, this solar incentive is under threat, as it’s currently uncertain in Washington and under attack in Oregon.

Local incentives: Funding for 2024 has been secured, but these are first-come-first-serve and subject to availability. Securing local solar incentives now ensures lower installation costs and an increased return on investment.

Utility rates: While the average yearly rate increase has been between 2 – 4%, the energy landscape has changed. Homeowners can now expect a 14 – 18% rate increase in 2024 with increased utility rates to come.

Securing these favorable incentives now allows you to hedge against rising utility rates, while the bonus of increasing your home’s market value should also be considered.

In a high-interest rate environment, channeling your funds into a lasting asset — your home — rather than continuing to rent power from the utility makes good financial sense.

Is solar panel financing worth it?

Solar is a reliable Investment. Unlike a rapidly depreciating asset like a car, a solar installation is an investment in price stability. Yes, interest rates are high, but so is the cost of utility energy. On the other hand, generating solar energy insulates your home from the volatility of rising utility rates.

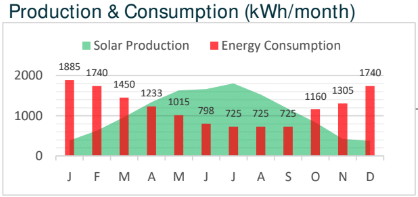

Imagine 25 – 30 years of clean, limitless energy. If your home can accommodate enough panels to cover total energy consumption, then it’s possible to eliminate a utility bill immediately.

Even without 100% energy offset, investing in solar now will expedite your home’s energy independence. The alternative would be continuing to rent energy from the utility and subjecting your home to increasing utility prices.

“The greater your belief electricity prices will continue increasing, the more attractive your solar investment will be.” [SOURCE]

If you’re paying less for utility energy due to energy offset provided by a solar installation, then this creates an opportunity to redirect funds from reduced electric bills. This flexibility enhances your overall financial health, allowing you to tackle other rising costs and unexpected expenses.

A solar installation changes your behavior

Consider the change in a homeowner’s relationship with energy consumption.

After installing solar, homeowners start paying more attention to their energy usage. To reduce their utility bill, they install more efficient lighting, heating, and cooling systems like heat pumps. They read their electricity bills paying close attention to how much energy their system generated, and how much they pay the utility for energy. The bottom line is that any amount of solar can save you money.

And while your solar panel financing rate is fixed, there are levers to pull to ensure you purchase less energy from the utility.

With changes in behavior, a homeowner can address the concerns around potentially paying an electric bill with solar panels. While one cost is fixed, reducing your energy consumption can ensure you only use energy generated from your system, effectively reducing your utility bill.

Solar ROI with high-interest rates

As of January 2024, the Federal Reserve intends to keep interest rates at 5.50%. That decision is based on a host of market indicators that no one person can predict. Inflation, job market strength, and a variety of other market indicators factor into the Fed raising or lowering interest rates. Predicting their movement in either direction, much like predicting the stock market, is fraught with uncertainty and should not be the only consideration when thinking about the financial viability of investing in solar.

On the other hand, installing solar has a proven, successful ROI for homeowners. As an example, consider the following homeowner’s perspective on their solar return on investment.

I invested $28,103, net of the tax incentives, and I got back $1,600 in savings including the banked kWh. That’s a 5.7% ROI.

($1,600 / $28,103) x 100 = 5.7%

That’s 5.7% tax-free with zero fees and very low risk.

So if I treat these as the tax-free low-risk part of an investment portfolio, from an ROI perspective this system is a win. And because of the likely increase in savings with each passing year, the effective rate of return will increase with each year. Still tax-free and very low-risk.

Despite the challenges posed by the current high-interest-rate environment, a solar energy system serves as a resilient investment, safeguarding against the escalating cost of renting your energy from the utility. With rate increases hovering around 18% starting in 2024, utilities have made it clear that volatile and unpredictable rate hikes are here to stay.

That’s why it’s important to consider a solar installation not as a sunk cost but rather as a strategic investment in a long-lasting asset. An investment that provides a safe, tax-free, consistent return. Yes, interest rates are high, but waiting for more favorable rates can have the opposite effect.

Consider losing out on the current solar incentives. Cash rebates from local non-profits aren’t guaranteed in the future. Net metering is under threat around the country, while the federal tax credit could eliminate 30% of the cost of going solar now.

Speak with a solar professional today to receive a free, no-obligation solar quote, and discuss solar panel financing options provided by our trusted financial partner, Puget Sound Community Credit Union.